Unmasking Privacy: The Best Anonymous Crypto Exchanges & No-KYC Platforms for 2025

Updated for 2025 — practical comparisons, security advice, and a clear checklist to trade privately while managing risk.

Why Privacy Matters in Crypto Trading

In a world where data is a commodity, financial privacy has become a core concern for many crypto users. Whether motivated by personal liberty, regulatory uncertainty, or protection against identity theft, traders increasingly prefer solutions that minimise personal data sharing. Learn more about cryptocurrency privacy on Investopedia. This guide covers the leading anonymous crypto exchanges in 2025, explains the practical differences between DEXs and CEXs, and gives actionable advice so you can trade privately and safely.

What “Anonymous” Really Means: DEX vs CEX

Decentralized Exchanges (DEX)

DEXs are non-custodial: trades happen peer-to-peer via smart contracts and you keep control of private keys. Typically they do not require KYC, making them the most privacy-preserving option for on-chain swaps, liquidity provision, and token trading. For detailed audits of decentralized exchanges, check CertiK or Trail of Bits for blockchain security research.

Centralized Exchanges (CEX) with Minimal KYC

Some centralized exchanges offer limited services without full KYC (email-only registrations, small withdrawal limits). They are custodial — meaning the exchange holds your funds during trades — and usually impose higher verification requirements for larger limits or specific services. Stay updated on privacy-focused exchanges via CoinDesk or Cointelegraph.

Top Anonymous & No-KYC Crypto Exchanges (Shortlist)

Below is a curated list of popular platforms referenced in the original article. Use the comparison table after this section to quickly assess which fits your needs.

- Best Wallet — non-custodial wallet-first solution, no KYC, MPC and Fireblocks integrations, wide chain support.

- GhostSwap — instant, registration-free swaps, non-custodial UX, broad token support.

- TorrentSwap — pure DEX, cross-chain swaps, audited smart contracts, strict no-KYC stance.

- BloFin — CEX offering spot & futures, allows higher unverified withdrawals (check current limits), Fireblocks custody.

- KCEX — CEX with generous no-KYC withdrawal thresholds for certain regions (confirm terms regionally).

- Changelly — hybrid swap provider, often allows small anonymous swaps (limits apply).

- Margex — derivatives CEX, email signup possible, high leverage products (risky).

- BingX — social trading + futures, many features available without immediate KYC for smaller accounts.

- SwapRocket — instant, non-custodial swaps, registration optional, very large token coverage.

- CoinFutures — anonymous futures trading with advanced tools and high leverage (check jurisdictional access).

Quick Comparison Table (At-a-Glance)

| Platform | Type | No-KYC Limit (example) | Key Privacy Feature | Best For |

|---|---|---|---|---|

| Best Wallet | Non-custodial (Wallet) | — (No KYC) | MPC, user keys | Long-term private custody + swaps |

| GhostSwap | DEX / Swap | — (No account) | Instant registration-free swaps | Fast private swaps |

| TorrentSwap | DEX (Cross-chain) | — | Audited smart contracts | Cross-chain privacy swaps |

| BloFin | CEX | Up to $20,000/day (example) | High unverified withdrawal cap | Spot & futures traders w/privacy needs |

| KCEX | CEX | Up to 30 BTC/day (example) | High no-KYC limit | High-volume traders |

| Changelly | Aggregator / Hybrid | ~1 BTC/day (varies) | Quick swaps, optional KYC for large tx | Casual private swaps |

| Margex | CEX (Derivatives) | Email signup; small limits | Low friction entry to leverage | Experienced leverage traders |

| BingX | CEX (Social) | Small trading/no KYC often | Copy trading without full verification | Social traders who value privacy |

| SwapRocket | Non-custodial Swap | — | Registration-optional instant swaps | Large token coverage + privacy |

| CoinFutures | CEX (Futures) | Varies — leverages anonymous entry | Cold-wallet storage + advanced risk tools | Advanced anonymous futures traders |

Note: Limits and features change frequently. Always verify current terms & regional availability on the official platform before trading.

Security Checklist Before Using Any No-KYC Platform

- Verify the official website (avoid phishing domains). Bookmark official URLs.

- Check smart contract audits (for DEXs) and security partners (e.g., Fireblocks, MPC).

- Use hardware wallets for large balances — keep private keys offline.

- Enable all available security features: 2FA (where applicable), withdrawal whitelists, and device checks.

- Use a reputable VPN if you want to add IP privacy, but weigh legal/regulatory implications in your jurisdiction. See EU GDPR Overview for privacy regulations.

- Test with small amounts first to confirm withdrawal flows and fees.

Risks Unique to Anonymous Trading — And How to Mitigate Them

No-KYC and anonymous platforms increase personal responsibility. Key hazards include scams, rug pulls, and permanent loss of funds due to lost keys. To reduce risk:

- Do thorough DYOR (team, contracts, community, audits).

- Avoid depositing large amounts in custodial no-KYC exchanges.

- Prefer audited DEXs and non-custodial flows for maximum privacy.

- Keep clear records of transactions if required by tax law in your jurisdiction.

Practical Workflow for Private Trading (Step-by-Step)

- Create a fresh non-custodial wallet (hardware wallet recommended).

- Purchase or swap small amount via a reputable DEX or swap provider (GhostSwap, SwapRocket).

- If using a CEX for liquidity or leverage, confirm withdrawal limits & only keep active trading capital on the exchange.

- Move long-term holdings to cold storage and keep only operational funds in hot wallets.

- Regularly review platform policies — KYC requirements may change.

Recommended Visuals & Infographics

- Hero image: abstract lock + crypto icons (featured image). Alt: “Privacy and cryptocurrency — anonymous exchanges 2025”.

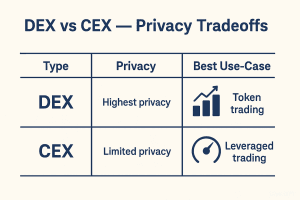

- Infographic: “DEX vs CEX — privacy tradeoffs” — simple 3-column graphic (Type, Privacy, Best Use-Case).

- Comparison visual: compact table image of the platforms above for social shares.

Pingback: Explosive: Top DeAI Projects Reshaping AI in 2025