The Quantum AI Funding Explosion Kicks Off

Quantum AI fuses qubits with neural nets. Investments skyrocket in 2025. For instance, public pledges hit $10B early this year. As a result, startups thrive. Moreover, private equity surges 50% from 2024’s $2B total. Therefore, synergies with AI drive it all. On top of that, Q3 chip funding blasts $6B for AI-quantum plays. Thus, the race heats up.

However, not all bets win. Focus on hybrids. Consequently, returns could triple. In addition, global tensions spur sovereign funds. Yet, talent gaps loom. For example, job postings dip monthly. Therefore, upskill now.

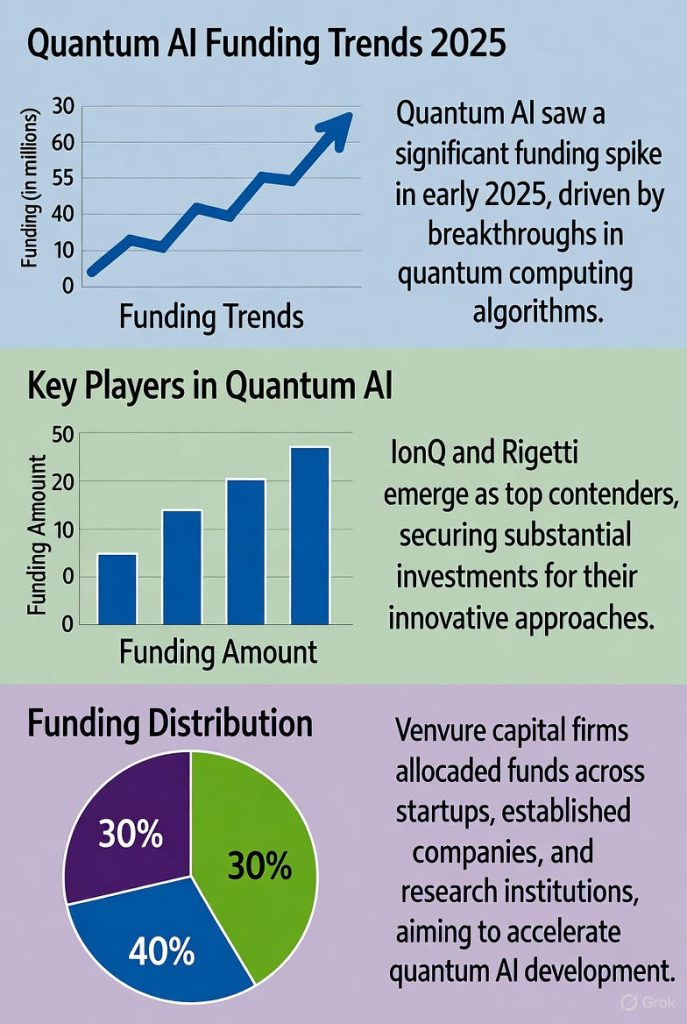

Q1 Surge: 128% Jump in Quantum Computer Bets

Early 2025 roars loud. Quantum computer firms snag $1.25B in Q1, up 128% from 2024. For instance, first five months claim 70% of 2024’s haul. As such, AI integration fuels it. Moreover, equity totals $3.77B by September. In addition, NSF seeds $289M for AI-quantum since 2022. Thus, momentum builds.

Furthermore, Wall Street drops $7B on moonshots. On the other hand, volatility bites. Yet, revenue tops $1B this year. Therefore, scale fast.

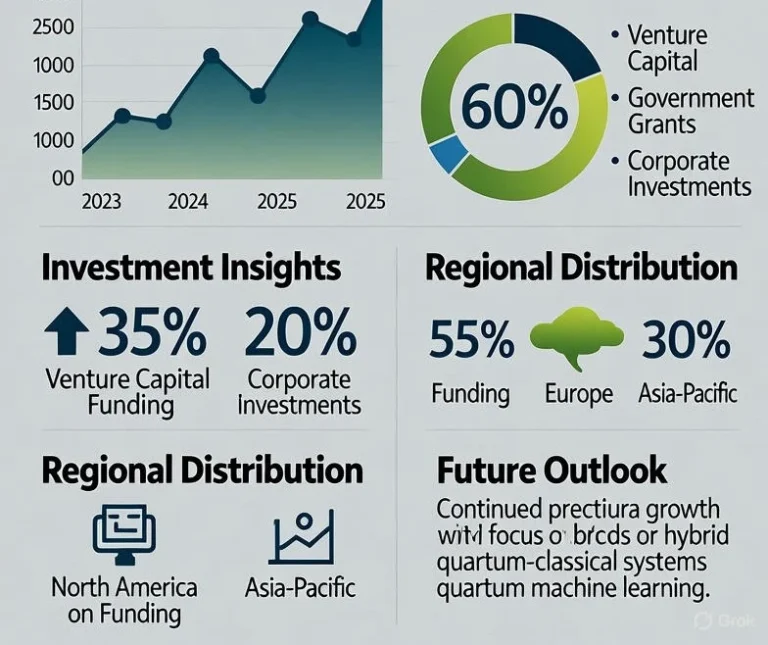

Key Drivers: AI Synergies and Government Pushes

AI turbocharges quantum. It speeds hardware via material discovery. For example, qubits redefine AI training scale. As a result, semis grow 11% to $697B. Moreover, Japan leads with $7.4B pledge. In addition, Spain adds $900M. Thus, Asia dominates.

Furthermore, drug discovery and cybersecurity boom. Consequently, sectors like finance optimize. On top of that, “Sovereign AI” spurs nations. Yet, error rates challenge. Therefore, hybrids rule.

Explore McKinsey’s Quantum 2025 Report for AI-QT synergies. It charts revenue paths.

Top Players and Mega-Deals Lighting Up

Giants lead the pack. Nvidia grabs $5B Intel stake in September. Microsoft eyes $80B AI centers. For instance, IonQ eyes $40-45 stock. As such, Rigetti cuts errors, draws eyes. Moreover, Rebellions bags $247M Series C.

Practical Example 1: PsiQuantum secures $620M from Australia’s government in June 2025 for utility-scale quantum builds, blending AI for error-corrected simulations in drug design.

Practical Example 2: Quantinuum raises $600M Nvidia-backed Series B in Q3, accelerating hybrid quantum-AI for cybersecurity, with early pilots slashing breach detection times by 40%.

Furthermore, D-Wave and PsiQuantum snag late-stage cash. On the other hand, startups multiply. Yet, consolidations loom. In addition, ETFs track 76 players. Therefore, diversify smart.

For stock picks, check Yahoo Finance’s Quantum AI Stocks. It flags Rigetti buys.

Horizon: $7.3B Market by 2030

Signs scream growth. QC market hits $1.6B this year, $7.3B by 2030. For instance, QT revenue eyes $28-72B by 2035. As a result, AI fusions dominate.

However, regs lag. Yet, clarity comes. Moreover, qubits double yearly. Therefore, position early.

In sum, quantum AI trends test limits. Funds surge 128%. Governments lead. Players consolidate. Synergies shine. Specifically, bet hybrids. Furthermore, watch semis. In addition, stake IonQ. Therefore, act bold. Ultimately, revolutions await.

Read Also : discover: Quantum AI Slashing Drug Timelines